Click here to view this briefing in PDF format.

The structure may only be used by alternative investment funds (“AIFs”) and their managers. As such, it is a suitable vehicle for funds pursuing private equity, private credit, infrastructure, real asset and similar investment strategies. The recently enacted Investment Limited Partnerships (Amendment) Act 2020 has modernised the ILP structure, bringing it in line with comparable partnership vehicles in other leading jurisdictions.

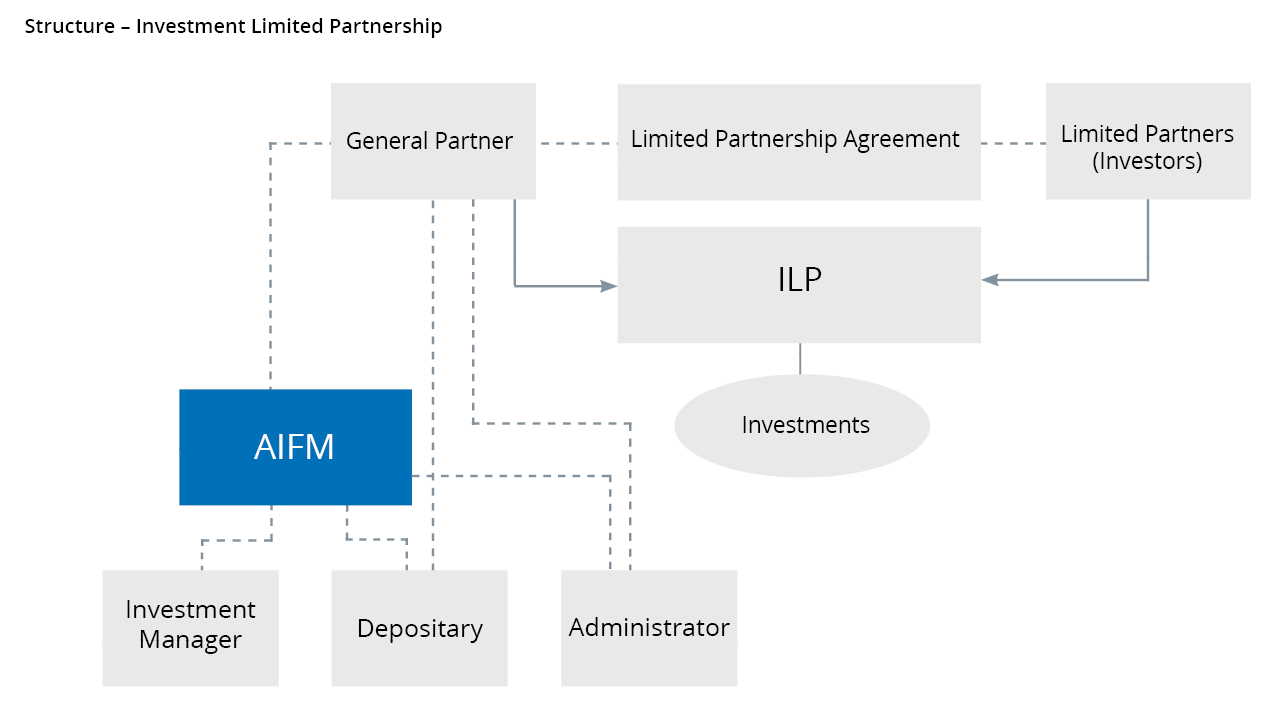

The ILP Structure

An ILP is established under the Investment Limited Partnerships Act 1994 (as amended) and is regulated by the Central Bank of Ireland. ILPs will typically be established as Qualifying Investor AIFs (“QIAIFs”). QIAIFs are generally not subject to investment or borrowing restrictions under the Central Bank’s AIF Rulebook subject to appropriate disclosure to investors. QIAIFs can avail of the Central Bank’s 24-hour approval process and may be marketed freely to professional investors across the EU and the EEA using the AIFMD marketing passport.

An ILP does not have separate legal personality. It has one or more limited partners (“LP”) (which are similar to shareholders in an investment company or ICAV, or unitholders in a unit trust), and a general partner (“GP”) that can enter into contracts on behalf of the ILP. There is no limit on the number of LPs in an ILP and in general they are not liable for the debts and obligations of the ILP beyond the amount of their commitment to the ILP. The GP is responsible for the management of the ILP’s business and is liable for the debts and obligations of the ILP. The Central Bank recently discontinued the practice of requiring a GP to be approved by the Central Bank as an AIF management company. However, the GP of an ILP is still subject to the Central Bank’s fitness and probity regime and so any directors of the GP will need to be approved by the Central Bank as performing pre-approval controlled functions.

The ILP structure is tax transparent for investors.

Enhancements to the ILP Structure

The Investment Limited Partnerships (Amendment) Act 2020 (the “Act”) was enacted on 23 December 2020. Some of the key enhancements it has made to the ILP structure are:

Umbrella ILPs: that are divided into compartments or “sub-funds” with segregated liability can now be established. The umbrella structure is attractive because it allows separate strategies or investor types to be accommodated in different sub-funds of the same umbrella rather than having to establish stand-alone partnerships for each.

LP Safe Harbours: if an LP takes part in the management of the ILP the LP loses the benefit of limited liability. The Act has clarified and broadened the safe harbours which allow LPs to undertake certain actions without being deemed to take part in the management of ILPs (e.g., sitting on advisory committees and approving changes to the limited partnership agreement (“LPA”)).

Amendments to the LPA and Approval by Majority of LPs: the Act removes the requirement for all LPs to approve an amendment to the LPA. Instead such an amendment will require approval by a majority of the GPs and a majority of LPs. The Act also allows for certain amendments to proceed without LP approval where the depositary certifies that the changes do not prejudice the interests of LPs. In addition, in line with partnership structures in other jurisdictions, the Act allows for the LPA itself to make specific provision as to what constitutes a “majority of limited partners” (e.g., a majority by value, by number or by class).

Withdrawal / Redemptions by Investors: the Act streamlines the process for the contribution and withdrawal of capital to and from ILPs and aligns the process with that applicable to other Irish fund vehicles and partnership structures in other jurisdictions.

Migration of ILPs: the Act provides for the migration-in and migration-out of Ireland by ILPs. The Act permits the GP of a migrating partnership registered in certain recognised jurisdictions, prescribed by statutory instrument, to apply to migrate to Ireland. Migrating partnerships may apply to the Central Bank to be registered as an ILP in Ireland by way of continuation.

Related Guidance on the Central Bank AIF Rulebook

In late Q4 2020, the Central Bank consulted on guidance in relation to permissible features of closed-ended AIFs (“CP132”), which will be relevant to managers that are interested in using the ILP structure. However, it is worth noting that, although the proposed amendments are being introduced on foot of the ILP changes, the guidance extends to all closed-ended fund structures, not just ILPs.

In summary, the key elements of the proposed guidance include:

Scope

The Central Bank is proposing to limit availability of these features to closed-ended AIFs authorised as QIAIFs (“CE QIAIFs”).

Share class features

The Guidance would permit CE QIAIFs to create differentiated share classes and the proposals include:

- permitting a fund to issue shares or other interests at a price other than net asset value without prior Central Bank approval;

- setting out the conditions applicable to the use of excuse provisions (which enable an investor to be excused from an investment that the fund proposes to make) and exclude provisions (which permits the fund to exclude an investor from a proposed investment that the fund proposes to make);

- permitting new investors to acquire interests in the fund at a later stage in its life cycle (stage investing); and

- allowing the establishment of management or “carry” classes which permit portfolio managers of a fund to participate in investments of the fund, including on the basis of conditions which differentiate the class from other classes in the fund.

A number of general conditions would apply to the establishment of differentiated share classes including that:

- the ability to establish the class has been provided for in the CE QIAIF’s constitutional document and has been disclosed to investors in advance;

- the investor’s interest in a CE QIAIF is proportionate to: (i) the capital it has paid into the CE QIAIF at a particular point in time; and / or (ii) the pre-determined flow of capital returns to the class; and / or (iii) the extent to which the class held by the investor participates in the assets of the CE QIAIF;

- where the investor has subscribed in the CE QIAIF on the basis of a capital commitment and periodic drawdowns from the investor, the CE QIAIF maintains records on a per-investor basis to enable it to clearly identify commitments paid and commitments outstanding for each investor (“capital accounting”); and

- the capital accounting methodology is consistent with the requirements under AIFMD.

Additional conditions apply to the use of the use of management classes and the use of excuse and/or exclude provisions including the following:

- the conditions applicable to management classes must be provided for in the prospectus, and capital payments (both committed capital and preferred returns) must be allocated to relevant investor classes in priority to management classes;

- the excuse and / or exclude provisions are predetermined and documented by the CE QIAIF; and

- a formal legal opinion must be provided by the investor or CE QIAIF (depending on the party invoking the provision) outlining the basis on which the excuse or exclude provision is being invoked.

This consultation closed on 22 December 2020 and the Central Bank is expected to finalise its guidance shortly.

Central Bank Q&A on General Partners of ILPs

According to the Central Bank’s recently updated AIFMD Q&A, the general partner of an ILP does not require separate authorisation as an AIF management company. The GP has statutory functions relating to its authority to conduct the business of the ILP, and is a regulated financial service provider – meaning that the directors or partners of a GP (or GPs, where there are more than one in an ILP) must be approved by the Central Bank under its Fitness and Probity regime – but it will not otherwise be authorised by the Central Bank.

How can Arthur Cox help?

The enhancements to the ILP introduced by the Act, together with the proposed guidance from the Central Bank, will enhance the attractiveness of Ireland as a jurisdiction for funds pursuing private equity, private credit, real asset and related strategies. At Arthur Cox we have significant experience advising on the establishment and management of partnerships and other private fund structures. If you require any further information, or are considering establishing an Irish ILP, please do not hesitate to contact a member of our team.