The EU Corporate Sustainability Reporting Directive (CSRD) requires in-scope companies to report annually on environmental, social, human rights and governance matters.

The European Union (Corporate Sustainability Reporting) Regulations 2024 (the Irish Regulations) transpose the CSRD into Irish law, amending the Companies Act 2014 (the Act) and the Irish Transparency Regulations 2007.

Key features include:

- New sustainability reporting obligations for large companies, listed SMEs and certain subsidiaries/branches of non-EU companies.

- Sustainability disclosures provided annually in a clearly identifiable dedicated section of the directors’ report in a machine-readable format.

- Reporting from a double materiality perspective – companies must assess what is material to the company in addition to how the company materially impacts people and the environment.

- Sustainability information reported in accordance with European Sustainability Reporting Standards (ESRS).

- Reporting subject to mandatory third-party assurance.

- Companies subject to disclosure obligations under the EU Taxonomy Regulation.

- Potential exemption for subsidiaries where their parent reports sustainability information on a consolidated basis.

Some anomalies have been identified in the Irish Regulations. Arthur Cox LLP, together with other professional advisers, are liaising with the Department of Enterprise, Trade and Employment (DETE) to address these issues. It is anticipated that the DETE will issue guidance to accompany the Irish Regulations which may provide clarity on some of the issues identified. We will continue to provide timely updates on any progress. Meanwhile, the European Commission recently published guidance in the form of FAQs on the interpretation of EU corporate sustainability reporting rules.

Scope & timeframe

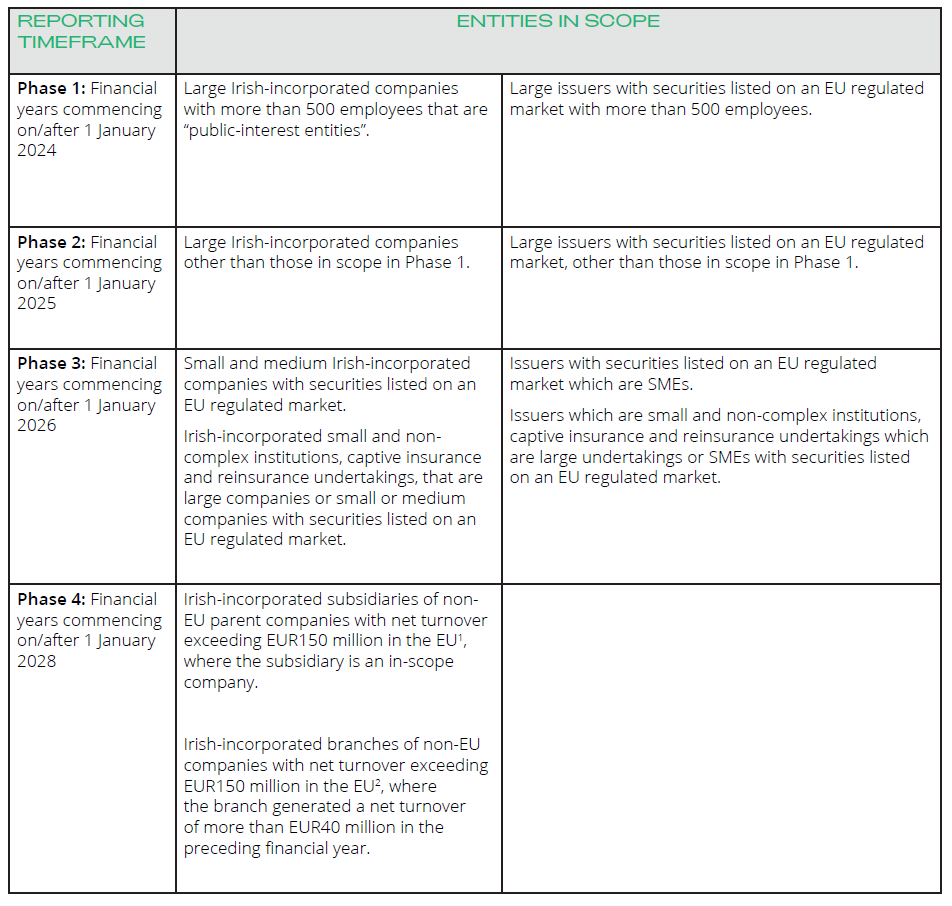

CSRD reporting obligations apply on a phased basis:

The reporting timelines for Irish-incorporated companies outlined above are tied to the definition of “applicable company” set out in the Irish Regulations. One of the anomalies identified in the Irish Regulations is that the definition of “applicable company” may inadvertently bring certain companies (including certain listed SMEs, micro-entities and financial services companies) within scope of the CSRD either earlier than anticipated or which were not intended to be within scope of the CSRD whatsoever.

A similar issue arose when the Non-Financial Reporting Directive was transposed into Irish law and resulted in the legislation being subsequently amended.

Micro-companies, AIFs, UCITs, credit unions and friendly societies are excluded from scope.

| A public-interest entity is an undertaking that either: (i) has securities listed on an EU regulated market; (ii) is a credit institution; (iii) is an insurance undertaking; or (iv) has been designated a “public-interest entity” by national legislation. A large company3 must exceed at least two of the following criteria on its balance sheet date: (i) balance sheet total EUR25 million; (ii) turnover EUR50 million; (iii) average number of employees 250. |

Non-EU issuers without EU subsidiaries or branches, who have exclusively wholesale debt securities (i.e. denomination per unit of at least €100,000 or equivalent) listed on the regulated market of Euronext Dublin, are out of scope for CSRD reporting. This is due to the wholesale debt exemption set out in Regulation 10 of the Irish Transparency Regulations 2007.

This briefing focuses on the sustainability reporting obligations for Irish-incorporated companies under Part 28 of the Act, as inserted by the Irish Regulations.

1 For each of the last two consecutive financial years.

2 For each of the last two consecutive financial years.

3 Includes the holding company of a group which satisfies the thresholds on a consolidated basis.

Sustainability reporting obligations

Key intangible resources

The directors’ report must include information on “key intangible resources” in relation to the company, and an explanation of how the business model fundamentally depends on such resources and how such resources are a source of value creation for the company.

Content of sustainability reporting

Part 28 of the Act sets out the sustainability information to be reported in the directors’ report, which includes: information on the business model and strategy; any time-bound targets related to sustainability matters (including greenhouse gas emission reduction targets); a description of the company’s polices in relation to sustainability matters; any incentive arrangements in place for those responsible for sustainability matters; and details of the due diligence process implemented with regard to sustainability matters, including in line with the requirements of EU law (for example under the EU Corporate Sustainability Due Diligence Directive (CSDDD) or the EU Deforestation Regulation (EUDR)).

Sustainability information must be reported from a “double materiality” perspective and in accordance with the ESRS.

ESRS

While Part 28 of the Act lists the sustainability information to be reported, the ESRS specify the disclosure requirements for this information.

The ESRS cover four reporting areas: (1) governance; (2) strategy; (3) impact, risk and opportunity management; and (4) metrics and targets.

The first set of ESRS were adopted by the European Commission on 31 July 2023 and are comprised of 12 sector-agnostic standards: two cross-cutting standards and ten topical standards covering environmental, social and governance matters.

Further ESRS are being developed including:

- ESRS for listed SMEs – exposure drafts were published for consultation in Spring 2024 (together with the exposure draft of the voluntary reporting standard for non-listed SMEs);

- sector-specific ESRS – currently being developed and due to be adopted by June 2026; and

- ESRS for non-EU companies – due to be adopted by June 2026.

| ESRS implementation guidance & support EFRAG recently published ESRS Implementation Guidance, covering materiality assessment, value chain and ESRS datapoints. EFRAG also recently published its third set of technical explanations in response to queries raised on its ESRS Q&A Platform together with a compilation of all technical explanations released to date. |

Double materiality

Sustainability information must be reported from a “double materiality” perspective, to understand:

- the company’s impacts on sustainability matters (impact materiality); and

- how sustainability matters affect the company’s development, performance and position (financial materiality).

Other than the cross-cutting ESRS 2 (General Disclosures) which are mandatory, the ESRS and their individual disclosure requirements and datapoints are subject to a materiality assessment, meaning that the company may omit the sustainability information that is not “material” for its business model and activity. Companies must therefore conduct a “materiality assessment” in order to assess whether a sustainability matter is material, from a financial materiality and/or impact materiality perspective, and therefore subject to disclosure requirements.

The directors must report on the materiality assessment process carried out to identify the sustainability information included in the directors’ report.

Value chain

The new sustainability reporting obligations place increased focus on the company’s upstream and downstream value chain.

Disclosures are required on the material impacts, risks and opportunities in relation to the value chain and companies must take into account their value chains, as well as their own operations, in conducting their materiality assessment.

The ESRS also require companies to report data regarding their value chain, however the reporting of value chain metrics is subject to a three-year phase-in period, where not all necessary information regarding the value chain is available.

Companies which are not directly in-scope of the CSRD (e.g. non-listed SMEs) may still be impacted by its reporting obligations as they may be requested to provide sustainability information to in-scope entities within their value chain.

Phase-in

In addition to the phase-in for value chain data, the ESRS include phase-in measures for certain reporting requirements (including on biodiversity and on various social issues) which largely will be applicable for companies with fewer than 750 employees.

Taxonomy regulation disclosures

Companies within scope of the CSRD will also be subject to disclosure obligations under Article 8 of the EU Taxonomy Regulation, regarding the extent to which their activities are associated with economic activities which are “environmentally sustainable”.

Sustainability reporting: Location, format & assurance

Location

Sustainability reporting must be included, for each financial year, in a clearly identifiable dedicated section of the directors’ report.

It is not permissible to prepare a separate sustainability report (previously an option under the Non-Financial Reporting Directive) and accordingly, sustainability information must be reported at the same time as the Irish statutory financial statements.

Single electronic reporting format

The directors’ report must be prepared in single electronic reporting format with sustainability information (including the disclosures required by Article 8 of the EU Taxonomy Regulation) “tagged” in accordance with an XBRL digital taxonomy.

Assurance of sustainability reporting

The sustainability information in the directors’ report is subject to mandatory assurance.

A statutory auditor, approved and registered under the Act to carry out the assurance of sustainability reporting, must provide an assurance report expressing an opinion on compliance with the requirements of Part 28 of the Act, the ESRS, the materiality assessment process, disclosures under the EU Taxonomy Regulation and the digital tagging of sustainability information. This opinion will be based, initially, on a limited assurance engagement.

The statutory auditor appointed to carry out assurance of sustainability reporting may be different from the statutory auditor appointed to carry out the statutory audit of the financial statements.

Irish legislation does not currently permit an independent assurance services provider other than a statutory auditor to provide the assurance report, however the DETE recently consulted on this option.

Group companies

Exemptions for subsidiaries

In-scope subsidiaries may be exempt from the obligation to report sustainability information in their directors’ report where the company and its subsidiaries (if any) are included in the group directors’ report of an EU parent company drawn up in accordance with the consolidated sustainability reporting obligations under CSRD. As currently drafted, this exemption is confined to circumstances where the EU parent company is also an Irish company, however it should also extend to a non-Irish EU parent company.

An exemption is also available where the in-scope subsidiary and its subsidiaries (if any) are included in the consolidated management report of a non-EU parent undertaking, provided that the consolidated sustainability reporting of the non-EU parent is drawn up in accordance with the ESRS or with reporting standards deemed equivalent to the ESRS. To date, no sustainability reporting standards have been determined as equivalent to the ESRS.

Exempt subsidiaries are required to publish the consolidated report and to include certain details in their own directors’ report, including links to the assurance opinion.

Under Part 28 of the Act, the exemption does not apply to subsidiaries which are large public-interest entities. This provision is more restrictive than the CSRD which provides that the exemption will not apply to large public-interest entities that are listed on an EU regulated market.

Artificial consolidation

Under a transitional measure available until January 2030, the CSRD permits an in-scope EU subsidiary to prepare a “consolidated sustainability report” including all in-scope EU subsidiaries which share a common non-EU parent.

The Irish legislation currently provides that the “artificial consolidation” measure is not available until financial years beginning on or after 1 January 2028 rather than with immediate effect, as provided under the CSRD.

Subsidiaries and branches of Non-EU companies

For financial years commencing from 1 January 2028:

- an in-scope Irish incorporated company that is a subsidiary of non-EU company which generated (at group or individual level) a net turnover of more than EUR150 million in the EU for each of the preceding two consecutive financial years; or

- an Irish branch (which generated a net turnover of more than EUR40million in the preceding financial year) of a non-EU company (which is either not part of a group or is a subsidiary of another non-EU entity and does not have an in-scope Irish subsidiary) which generated (at group or individual level) a net turnover of more than EUR150 million in the EU for each of the preceding two consecutive financial years,

will be required to publish a sustainability report on a consolidated basis for the group (or, if not applicable in the case of a branch, for the non-EU company) drawn up in accordance with specific ESRS for subsidiaries/branches of non-EU companies (not yet adopted).

Alternatively, the subsidiary/branch may report in accordance with the ESRS, or in accordance with sustainability reporting standards which are deemed equivalent to the ESRS. To date, no sustainability reporting standards have been determined as equivalent to the ESRS.

The publication of the sustainability report must be accompanied by an assurance opinion from a person or firm authorised to give an opinion on the assurance of sustainability reporting, either under national law of the non-EU company or under the laws of an EU Member State, or a statutory auditor approved to carry out the assurance under Part 28 of the Act.

Non-compliance

For Irish reporting companies, sustainability reporting will form part of its annual directors’ report and is therefore subject to the existing obligations regarding the preparation of a directors’ report under the Act.

Interaction with EU & international regimes

EU Taxonomy Regulation

As noted above, companies within scope of the CSRD will also be subject to disclosure obligations under Article 8 of the EU Taxonomy Regulation.

CSDDD and EU legislation

Reporting obligations include the due diligence process implemented with regard to sustainability matters and where applicable, in line with the requirements of EU law in this regard. This may include due diligence obligations under the CSDDD and, depending on the nature of the company’s operations/those of its value chain, specific due diligence obligations including under the EUDR, Conflicts Minerals Regulation and Batteries Regulation.

Companies that are subject to CSRD reporting are exempt from the requirement to publish a separate annual CSDDD report.

Companies that report a (or are included in their parent undertaking’s) transition plan for climate change mitigation under the CSRD will be deemed to have complied with the obligation to adopt a transition plan under the CSDDD.

Global sustainability reporting landscape

The CSRD exists alongside other sustainability reporting frameworks, including the SEC’s climate disclosure rules (currently stayed) and the International Sustainability Standards Board’s sustainability disclosure standards, a voluntary reporting framework (which the UK is planning to incorporate into its proposed UK Sustainability Reporting Standards Framework).

The European Commission and EFRAG have indicated that they have worked to ensure a high level of alignment between the ESRS and the ISSB standards and those of the Global Reporting Initiative.

This publication is provided for your convenience and does not constitute legal advice. This publication is protected by copyright. © 2024 Arthur Cox LLP.